Yatırım Kararı Alma Sürecimiz

Yatırım sürecini 360 derecelik bir süreç olarak tanımlıyoruz.

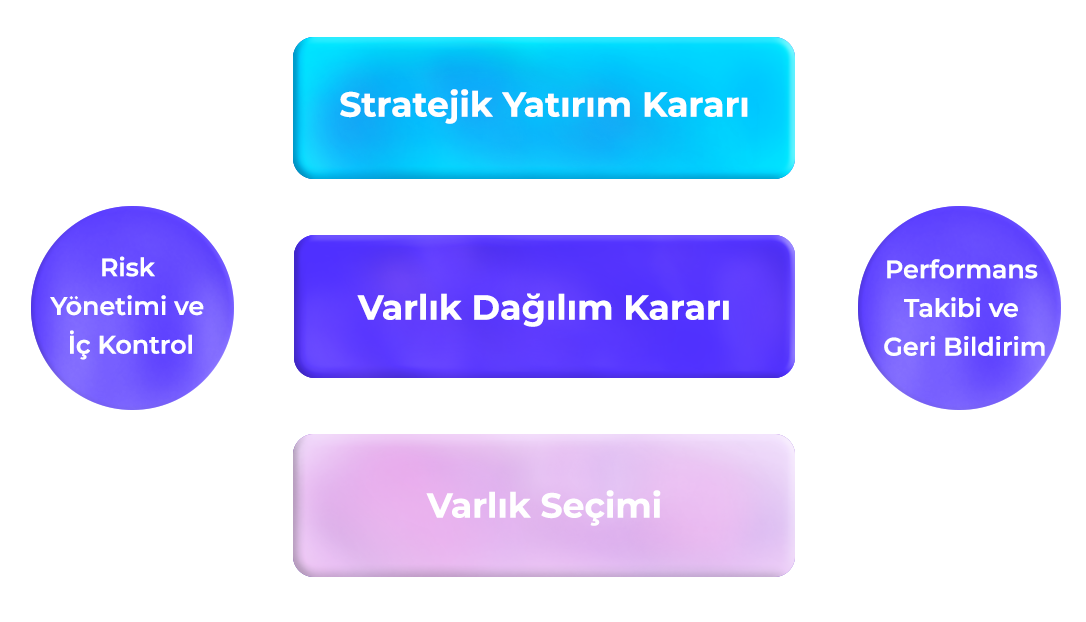

Yatırım hedefini ve risk tolerans seviyesini tanımlayarak yatırım karar alma sürecini başlatıyoruz. Kullanılabilecek finansal ürünler ve oranlarının tanımlanması ile ilgili yatırım stratejisi özeline hareket alanı belirlenmiş olur. Stratejik yatırım kararı, getiri hedefimize hangi yatırım araçlarıyla ulaşacağımızın belirlenmesi açısından son derece önemlidir. Taktiksel varlık dağılım kararları ise konjontürel olarak oluşan avantajları değerlendirmek amacıyla kullanılmaktadır. Varlık dağılımı, risk/getiri perspektifi çerçevesinde optimizasyon yöntemleri kullanılarak desteklenir. Yatırım kararı alınan varlık grupları içerinden yapılacak varlık seçimlerinde uluslararası literatürde “top-down” olarak nitelendirilen “yukarıdan aşağıya seçim” yöntemi kullanılır.

Yatırımlar ile birlikte eş zamanlı yürütülen iç kontrol ve risk yönetimi süreci yatırımlar sonrasında detaylandırılarak sürdürülür. Kapsamlı performans izleme faaliyeti; sonuçların değerlendirilmesinde çıktı, yeni kararların alınmasında girdi olarak kullanılır.